International and global funds have been increasingly popular as markets have gotten more accessible. These funds have the potential to be very significant components of a portfolio, providing investors with a way to participate in the global economies’ growth potential. Additionally, investors can lower their exposure to specific risks by diversifying across a range of markets and industries. When considering the broader investment landscape, exploring future & option trading strategy can also play a role in shaping a well-rounded and diversified portfolio.

What is considered a global investment in the stock market?

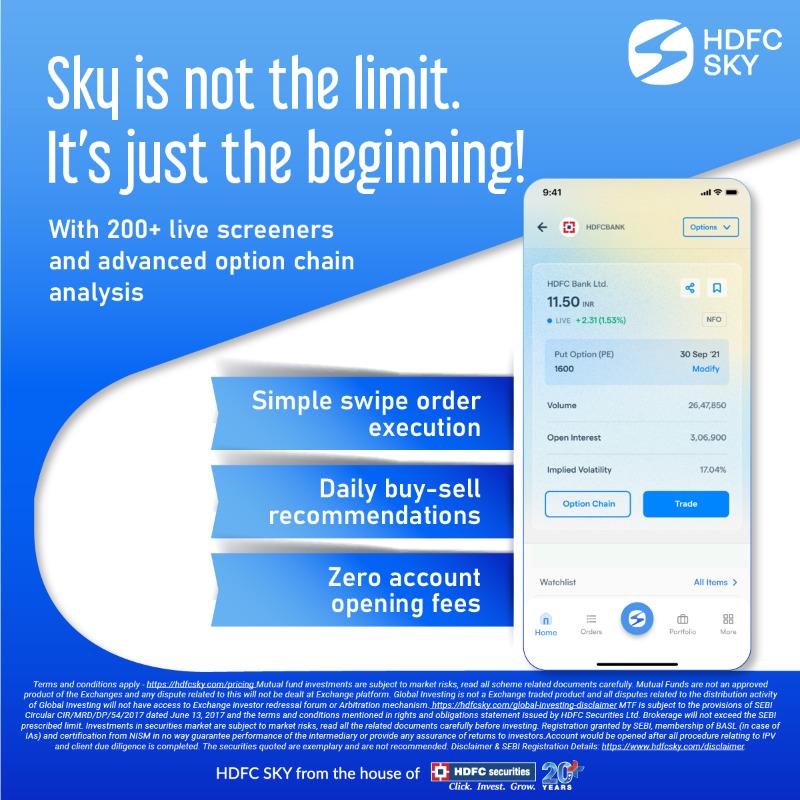

Investing globally involves holding stocks or shares of companies based outside of your native nation to diversify your financial portfolio. These investments may serve as a buffer against risk and growth in other economies. For those looking to expand their investment strategies, considering opportunities to invest in F&O stocks by using an options trading app can add another layer of flexibility.

1. A diversified portfolio reduces risks by limiting exposure to any one asset through a combination of several asset classes and investment vehicles. It functions similarly to a risk management plan, enabling you to generate larger returns down the road. In times of market turbulence, a diverse portfolio provides stability. Because there is less correlation between domestic and international equities, if your investments are spread across different regions, changes in the economy in one country won’t have an impact on your other investments. Exploring additional strategies, such as options trading online, can further enhance the versatility of your diversified portfolio.

2. Investing in international markets through investment apps in India will provide access to a wide range of stocks. With careful investigation, it is possible to shortlist the stocks. Many equity investing options accessible today are in industries not listed on Indian stock markets. These industries include payments like Visa and MasterCard, consumer brands like Nike, e-commerce behemoths like Amazon, and consumer internet giants like Facebook.

For those looking to explore more advanced strategies in a trading app, delving into opportunities in F&O can offer a sophisticated layer to their investment approach.

3. The possibility for growth is another reason why investors might decide to make international investments. Since the US market is regarded as mature, its potential for growth may be lower than that of other economies. Investing globally gives investors the opportunity to profit from expanding economies, especially in emerging markets.

4. “It is very simple” is one of the strongest arguments for investing internationally. Using mutual funds makes it quick and easy to accomplish this. It is a path you can choose if you are a relatively cautious investor. Fund companies provide foreign funds that allow you to take advantage of the experience of international fund managers. Fund of funds strategies, which invest in foreign shares, are available at many Indian fund firms. These funds allow you to invest just like any other mutual fund. While mutual funds offer simplicity, for those seeking more active and sophisticated approaches, exploring opportunities in stock trading can add another dimension to their investment strategy.

5. The value of the rupee has decreased in relation to the US currency. Simply by virtue of currency exposure, any investment you make in US dollars has the potential to increase your returns significantly. Investing in foreign assets may provide a hedge against the weakening rupee and global market volatility.

Conclusion:

Expanding your stock portfolio through global investing will undoubtedly benefit you. However, you should only profit from international investment if you have sufficient expertise trading in your home country and valuable input.