There’s nothing like the rush of seeing that acceptance letter. After months, sometimes years, of effort, you finally get into the university you’ve been dreaming of. Excitement fills you, but soon enough, reality knocks at the door. Tuition, hostel charges, books, travel, it all adds up so quickly. For many students and families in India, fees become the single biggest roadblock between ambition and achievement.

That’s where a mobile loan app can step in. Instead of running from one bank counter to another, waiting for approvals that may take weeks, students and parents today have the option to get financial support with just a few taps.

- Why digital loans make sense for students

Education is time-sensitive. Deadlines don’t wait. If you miss the fee payment date, your seat may be gone. This is why an online loan application has become such a lifesaver. You don’t need to carry piles of documents or stand in endless queues. You can upload what’s needed through your phone and get updates instantly.

Think of it this way: if ordering food, buying clothes, or booking tickets has gone digital, why should education finance remain stuck in old systems?

- Indian apps stepping up

Over the past few years, the rise of the Indian loan app has been remarkable. Local platforms understand the urgency of students and the limitations many families face. They’ve designed their process to be quick, transparent, and flexible. Unlike traditional lenders, these apps often provide smaller ticket loans too, which is perfect if you’re just covering one semester’s fees, hostel charges, or study material.

Plus, since they’re digital-first, there’s less paperwork, fewer hidden charges, and faster communication. For students who are already too stressed about assignments and admissions, this simplicity is a huge relief.

- Personal loans tailored for education

Of course, the main tool students rely on is the personal loan app. Personal loans, unlike rigid education loans, don’t always ask for collateral or guarantors. That means you don’t need to mortgage property or scramble for a co-signer. The flexibility is refreshing, you can decide how to use the amount, whether it’s tuition, gadgets like a laptop, or even travel if your college is in another city.

And repayment? Many apps now give the option to start paying back once you’re settled or earning. This means your studies don’t get interrupted because of money worries.

- Beyond the numbers: peace of mind

Getting into your dream university is already such an emotional milestone. It feels unfair that money should dampen the joy. With digital financial tools, you get a chance to focus on what really matters: studying, making friends, and discovering new paths, without constant financial anxiety.

It’s not just about “funds in your account.” It’s about freedom. Freedom to attend classes without wondering if you’ll be asked to leave. Freedom to buy the right books without cutting corners. Freedom to dream bigger because money isn’t pulling you back every step of the way.

- A word of balance

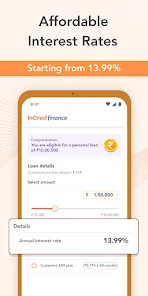

Of course, loans should be taken with awareness. Borrow what you can repay comfortably. Check interest rates, read terms carefully, and compare different platforms before choosing one. The good part is that most digital apps make these details clear upfront; you don’t have to guess or chase a loan officer for information.

Final thought:

Your dream university said yes. That’s half the battle won already. For the rest, the world of digital finance has opened doors that earlier generations didn’t have. Whether it’s through a mobile loan app or a trusted Indian loan app, the path is now far more accessible. With a personal loan app, you can step into campus life knowing that while challenges will come, money won’t be the one holding you back.

Because dreams deserve a fair chance, and education should never be sacrificed at the altar of fees.