Stock Invest has become increasingly accessible with the various online platforms and apps you have in our current world. It is a gem for those who are looking for a stock trading app. Whether you are an expert investor or an underdog of this amazing topic, understanding how to use the tools effectively can help to make better decisions for high returns

1. Understanding of the Stock Market in India

The stock market India has a long and interesting history. it plays a significant role in the economy. Nowadays, trading is as easy as online shopping, anyone can find all the publicly listed companies and trade.The two most renowned and primary exchanges of the Indian market are The Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). Both exchanges ensure transparency and protect the investors from buying and selling shares.

2. Why Should You Invest Online?

With today’s tech, it has become easier than ever to invest online. Even these Online investment platforms offer multiple advantages, which are as follows:

- Convenience: You can trade staying in bed and even while traveling, it’s that easy. All you need is just your smartphone and internet connection.

- Real-time Access: Get real-time data and updates on stock prices, helping you make timely decisions.

- Lower Fees: Online platforms often have lower transaction fees in comparison with traditional brokerage services.

- Educational Resources: Many platforms provide educational resources and tools to help you understand the market better.

Points to remember while choosing the right trading platform

- It all starts with selecting the right trading platform for your needs. The factors one should consider while choosing the platform are mentioned below:

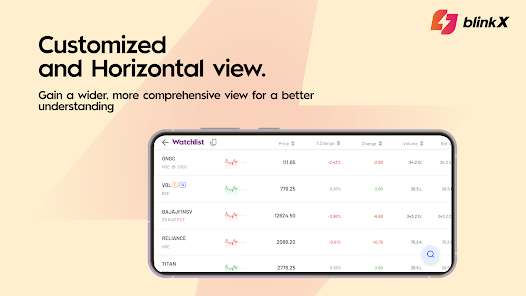

- User Interface: Finding an easy-to-use platform is the first challenge, especially for beginners.

- Security: It’s crucial to check whether your platform provides robust security and keeps your personal information safe from threats.

- Customer Support: Online platforms and apps can be faulty sometimes, so having the right platform that provides good customer support is all you need in your journey.

- Additional Features: Look for features like research tools, market analysis, and alerts.

3. Getting Started with Online Trading

To get started with online trading, follow these steps:

- Research: Having basic knowledge about the stock market and identifying your goals can help you to kick start.

- Choose a Platform: Selecting a reliable, easy-to-use platform is a must. It can help to make certain decisions and understand the crucial facts.

- Open an Account: Signing up properly and completing the procedures including KYC is necessary for a flawless journey.

- Fund Your Account: Transfer funds from your bank account to your trading account.

Conclusion:

Investing in the stock market is very risky but on the other hand, it can be an amazing experience if done correctly. Using a good stock trading app can help you to simplify all the factors and helps you to understand the stock market in India clearly and also helps you to make certain decisions. Whether you are a fresher or an experienced person, giving it the required time to learn all the facts and understand how it works, can lead you to success. So, why wait? Start your online investing journey and take control of your financial future.